(3 minutes read)

- Oil prices are on a spiral and reaching dizzy heights thanks to Russia-Ukraine war and analysts expect it might go past the prices when they spurted nearly a decade ago

- U.S. WTI rose to as high as $111.50, the highest since 2013

- The North Sea Brent crude hit $113.02 on Thursday (3rd March)

- Prices generally increased by 5%

- There are fears of commodity prices going North, particularly aluminium, creating consternation across the commodity markets in the world

- Natural gas prices are also set to go up

Oil prices are on a spiral and reaching dizzy heights thanks toRussia -Ukraine war. Analysts expect it might go past the prices when they spurted nearly a decade ago.

U.S. WTI rose to as high as $111.50, the highest since 2013. The North Sea Brent crude hit $113.02 on Thursday (3rd March). It is the highest since 2014. Though there was some respite at the end of the day, prices generally increased by 5%. There are fears of commodity prices going North, particularly aluminium, creating consternation across the commodity markets in the world. Natural gas prices are also set to go up.

Also read:

https://trendsnafrica.com/russia-ukraine-war-may-affect-food-grain-supplies-to-africa/#:~:text

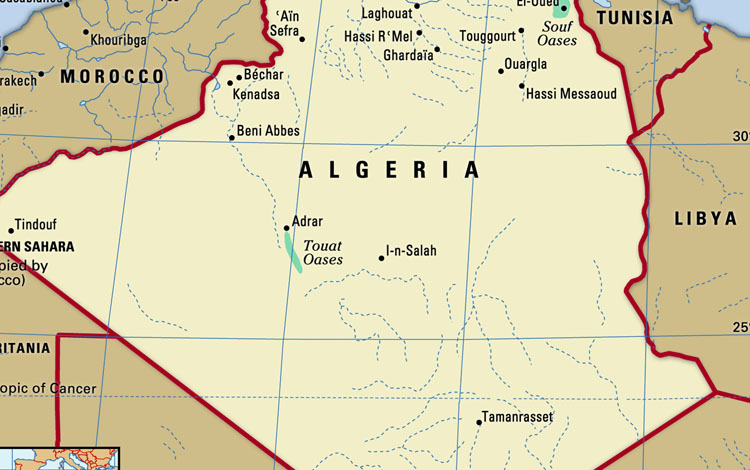

Russia is the world’s second largest exporter of crude oil and accounts for more than 40% of the EU’s annual natural gas imports. Following Ukraine’s invasion by Russian forces the European Union and the US have imposed tough sanctions on Moscow which could lead to the disruption of supplies. Western forces are looking for alternatives to meet their energy needs. Some of them are turning towards some of the North African countries like Algeria, Tunisia and CIS countries like Tunisia.

The Russia-Ukraine conflict happened at a time when prices of energy and commodities were increasing following the lifting of Covid-19 restrictions in many countries. In 2021, Russia being the world’s third-largest aluminium producer after China and India, the war and subsequent supply disruptions can create price increases for this commodity, much in demand for its industrial and household uses. Turkey, Japan, China, the United States and the European Union are the main importers of Aluminium from Russia.

Some of the oil producing countries in the continent like Nigeria, Angola, Central Asia Republic et may be major beneficiaries of this hike. But oil importing countries may find the going bit tough since the increase is coming at a time when the economies are showing some positive growth, leaving behind tumultuous periods during the pandemic.