(3 minutes read)

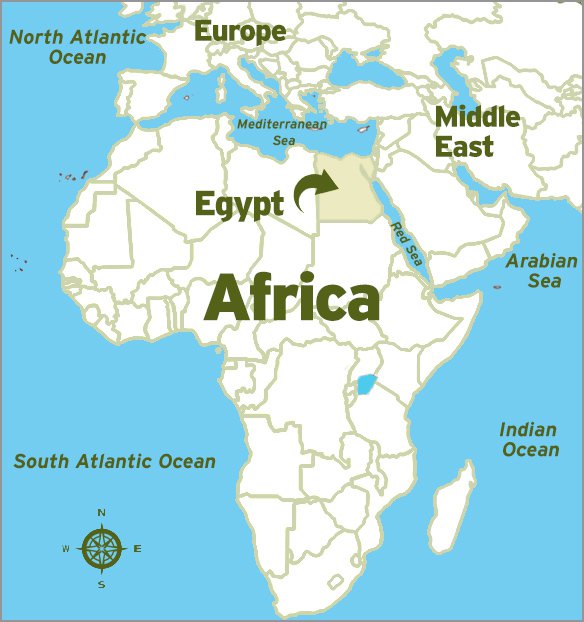

The Sovereign Fund of Egypt (TSFE) announced recently the completion of the acquisition of the Saudi Egyptian Investment Company, wholly owned by the Public Investment Fund (PIF), in four leading Egyptian companies listed on the Egyptian Stock Exchange. The deal is valued at the US $1.3 billion

The Sovereign Fund of Egypt (TSFE) announced recently the completion of the acquisition of the Saudi Egyptian Investment Company, wholly owned by the Public Investment Fund (PIF), in four leading Egyptian companies listed on the Egyptian Stock Exchange. The deal is valued at the US $1.3 billion. The news about the deal was reported by www.trendsbafrica.com a few days ago. Now the details of the deal have been completely worked out. The companies where investments are taking place are Abu Qir Fertilizers Co., Misr Fertilizers Production Company (MOPCO), Alexandria Containers and Cargo Handling Co., and e-finance.

Hala El-Said, Egypt’s Minister of Planning & Economic Development and Chairperson of The Sovereign Fund of Egypt said that the deal has been struck within the framework of the state’s plan to expand the ownership base and encourage foreign direct investment and would support Egypt’s sovereign fund strategy in attracting Arab and foreign investors. It would also provide promising investment opportunities in various economic sectors to the Saudi company for mutual benefits. Foreign investors consider Egyptian companies were strategically important for investments.

This deal comes to activate the agreement between the Arab Republic of Egypt and the Kingdom of Saudi Arabia that was signed last June regarding the investment of the Saudi Public Investment Fund in Egypt in cooperation with TSFE.

The Saudi Egyptian Investment Company agreed to buy 25 percent of the shares of the Misr Fertilizer Production Company (MOPCO). It is at a premium price of 25 percent over the stock price on the stock exchange. MOPCO’s share ended trading on the Egyptian Stock Exchange (EGX) on Monday (8 August), at LE 104.89, down 0.6 percent, bringing the company’s market value to about LE 24 billion, while its capital is LE 2.291 billion, distributed among 229.117 million shares, with a nominal value of LE 10 per share. MOPCO, owned by the Egyptian government, was established in 1998. It specializes in the production of fertilizers, ammonia, and nitrogen.

Read Also:

https://trendsnafrica.com/digital-payment-system-is-becoming-popular-in-egypt/

https://trendsnafrica.com/egypt-hosts-somalian-president-hassan-sheikh-mohamud/

https://trendsnafrica.com/egypts-army-affiliated-companies-allowed-to-sell-petroleum-products/

The company’s profits increased to LE 2.08 billion in the first quarter of 2022, compared to LE 792.7 million a year earlier, while revenues increased by 111.5 percent during the same period to LE 4.21 billion. MOPCO is also one of the largest exporters of urea in Egypt, producing about two million tons annually. Its products are exported to Europe, Latin America, Asia, and Africa. The details of deals with the other three companies are being collated by www.trendsnafrica.com.