(4 minutes read)

Nigeria’s President Muhammadu Buhari continued to defend the currency swap despite its ramifications and political fallouts. However, he ordered old, small denomination 200-naira notes to remain in circulation as a measure to defuse the scarcities

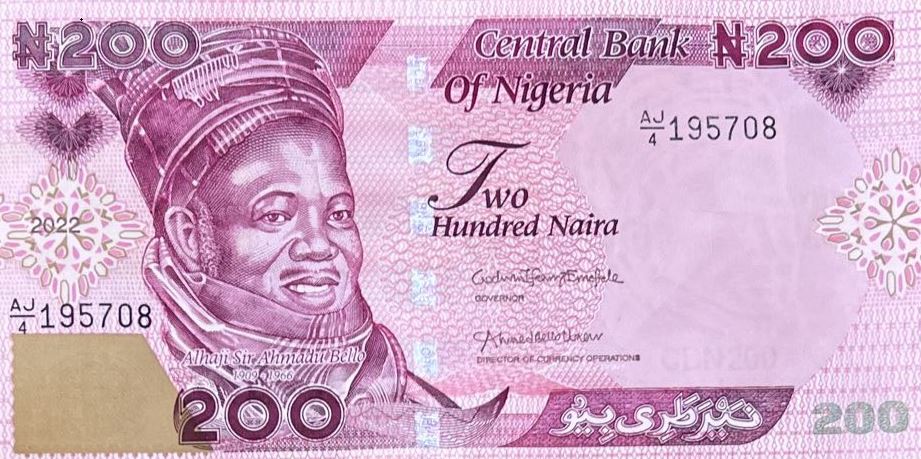

Nigeria’s President Muhammadu Buhari continued to defend the currency swap despite its ramifications and political fallouts. However, he ordered old, small denomination 200-naira notes to remain in circulation as a measure to defuse the scarcities. As reported by www.trendsnafrica.com from time to time, the Central Bank of Nigeria (CBN) began to swap old bills of the local naira currency for new, re-designed ones, causing considerable hardships to people. The country is going to polls this week and the independent election commission also said that some of the expenditures to be incurred during the election have to be settled in cash.

In the meanwhile, Buhari described the naira policy as a positive departure from the past and said it represented a bold legacy step towards free and fair elections by helping to curb vote buying. The incumbent president is stepping down after his two terms as mandated by the country’s constitution. President, at whose initiative the step was taken, always maintained that the bold decision would purge the country of corruption and electoral malpractices, where money plays an important role.

Acknowledging the hardships suffered by people over the shortage of currency, Buhari said that old 200 bank notes would continue in circulation as legal tender money. This he hoped would ease the hardships being faced by the citizens and small businesses. Earlier, redesigned currencies were introduced for 200, 500, and 1,000-naira notes.

The Central Bank said that the old 200-naira bills will circulate as legal tender for 60 days until April 10 along with the new notes. Buhari urged the central bank to make available more newly designed currency notes. Nigeria is a cash-driven economy. In the informal sector, it is estimated more than 45 % of the transactions are done using cash.

Read Also:

https://trendsnafrica.com/aus-90-strong-election-oversight-mission-to-visit-nigeria/

https://trendsnafrica.com/currency-crisis-in-nigeria-creates-havoc/

Some state governments have taken the central bank to court, seeking to suspend the policy and allow Nigerians to use both the old and new notes till the situation is eased. The Court will give its verdict on 22 February.