(3 minutes read)

Burundians are reacting to the new 5,000 and 10,000 Burundian franc banknotes recently put into circulation. They experience difficulty in exchanging their old notes for new ones, particularly since the expiration of the deadline in June. However, many encounter difficulties with trade owing to their lack of new currency notes in circulation

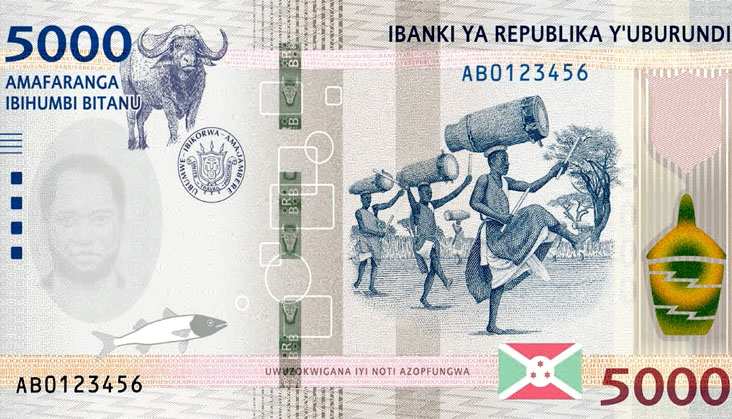

Burundians are reacting to the new 5,000 and 10,000 Burundian franc banknotes recently put into circulation. They experience difficulty in exchanging their old notes for new ones, particularly since the expiration of the deadline in June. However, many encounter difficulties with trade owing to their lack of new currency notes in circulation.

The two denominations, worth US$1.77 U.S. and US$3.54 U.S., are the highest of the six in circulation in a country with a per capita GDP of US$270. The Bank of the Republic of Burundi attributed the move to what it called an increase in circulation in the informal circuit that led to instability in the activities of financial institutions. It also said in its press announcement that there was a shortage of these notes in banks that destabilized activities.

All 5,000- and 10,000-franc notes dated July 4, 2018, were withdrawn as of June 7, and replaced by new ones dated Nov. 7, 2022. There was a 10-day time limit that expired on June 17 for holders to deposit the old notes in their accounts and to open a bank account if necessary. The old notes were to be legal tender only until June 17.

Read Also:

https://trendsnafrica.com/un-secretary-general-in-burundi-calls-for-speedy-process-in-drc/

https://trendsnafrica.com/burundi-throws-open-border-with-rwanda/

Further restrictions by the Bank of Burundi limited individual total deposits of cash to 10 million francs ($3,543) and legal entities to 30 million francs per day and per account. Burundi’s apex bank has said it would deploy agents to rural areas to assist in the exchange.