(3 Minutes Read)

The French engine manufacturer is among the 130 aerospace companies active in Morocco, where parts ranging from wings to fuselages are produced in an industry that employs 42% women — a proportion that industry lobbyists say is larger than its European and North American manufacturing industry counterparts.

In Morocco, efforts to grow the country’s US$2 billion-a-year aerospace industry are part of a years-long push to transform the largely agrarian economy through subsidizing manufacturers of planes, trains, and automobiles. Officials hope it dovetails with efforts to grow Moroccan airlines, including the state-owned Royal Air Maroc.

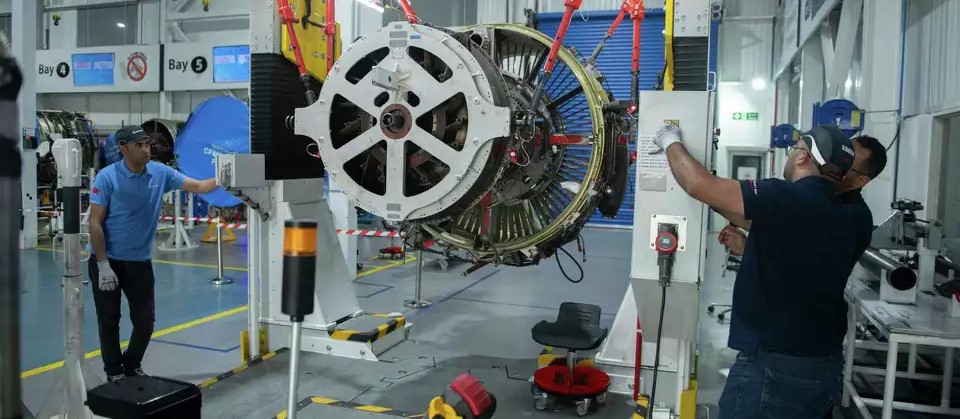

Safran Aircraft Engines sends Boeing 737s and Airbus 320s to a repair plant outside of Casablanca every six to eight years and then sends them back to airlines from countries including Brazil, Saudi Arabia, the United Kingdom, and Ireland.

The French engine manufacturer is among the 130 aerospace companies active in Morocco, where parts ranging from wings to fuselages are produced in an industry that employs 42% women — a proportion that industry lobbyists say is larger than its European and North American manufacturing industry counterparts.

Though many companies eye Morocco as a source for comparatively cheap labor, the industry and government have worked to train skilled workers at IMA, an institute for aeronautics professions in Casablanca.

Despite hopes among its cheerleaders, the air travel industry faces headwinds. When demand rebounded after much air travel stopped during the pandemic, manufacturers faced challenges building enough planes to meet demand from airlines.

Read Also:

https://trendsnafrica.com/israel-company-bluebird-to-open-defense-production-base-in-morocco/

For Boeing, delays caused by supply chain issues were compounded by high-profile emergencies and deadly crashes that further curtailed deliveries. From Eastern Europe to Southeast Asia, new levels of demand have forced manufacturers to seek out new locations to build and repair parts.