(3 minutes read)

- The value of mobile money transactions in Kenya went up after the government waived off the transaction charges on March 16, 2020, as part of the emergency measures to facilitate money transactions during the Covid-19 pandemic.

- The move had created something akin to a cashless economy.

The value of mobile money transactions in Kenya went up after the government waived off the transaction charges on March 16, 2020, as part of the emergency measures to facilitate money transactions during the Covid-19 pandemic. The move had created something akin to a cashless economy.

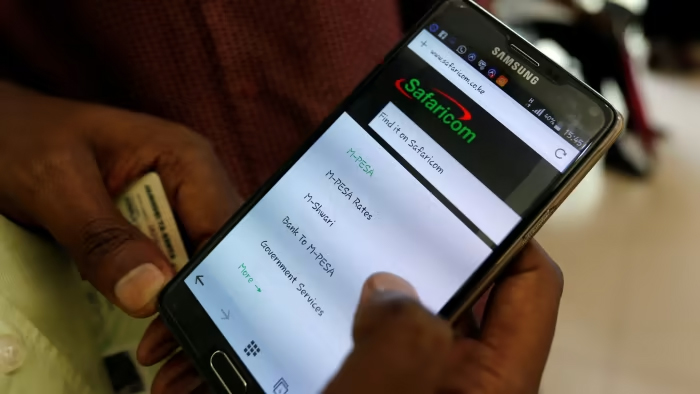

According to the Data from the Central Bank of Kenya (CBK), mobile money transactions touched 56.8 percent of GDP by the end of 2021 from 48.7 percent in 2020. Mobile money transactions stood at Sh6.7 trillion against a GDP of Sh12.1 trillio in 2021. As per the CBK analysis, the mobile money transaction in 2022 is projected to rise to 68 percent by the end of the year.

CBK put an end to the waiver and announced the restoration of charges for transactions between mobile money wallets and bank accounts on December 6.

Also read;

https://trendsnafrica.com/mobile-transactions-in-kenya-grows/

https://trendsnafrica.com/m-pesa-leads-the-african-fintech-space/

The resumption of the charges, experts fear will drive people back to using cash and deprive the budding cashless economy. Several Banks have urged CBK to restore the waiver as cashless transactions make banking dynamic and good for the economy. At the same there is also an argument that the charges are needed as they have invested heavily in the technology. Kenya has been hailed as a leader in mobile banking after the invention of M-Pesa in 2007.