(5 minutes)

· G-20 countries initiatives to write off the Debt Service Suspension Initiative (DSSI) are being hotly debated

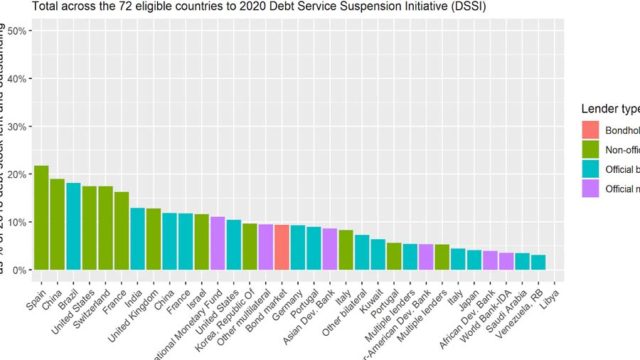

· As per the information available in the public domain, at least 45 of 73 eligible countries can defer repayment amounting to US$ 5 billion under the official sector debts

· According to experts, it is partial and does not apply to multilateral and private creditors

· Money freed up under the DSSI may effectively be used to repay other debts and not to fund the response to the Covid-19 crisis

G-20 countries initiatives to write off the Debt Service Suspension Initiative (DSSI) are being hotly debated. As per the information available in the public domain, at least 45 of 73 eligible countries can defer repayment amounting to US$ 5 billion under the official sector debts. Against the backdrop of present situation, such as Covid-19, flooding in some countries, locust attack on food crop etc, many feel the deferment of payment is grossly inadequate to tie down the present crisis, especially when a global movement campaigning to end extreme poverty and preventable disease by 2030 is in operation.

www.trendsnafrica.com feels that the Debt Service Suspension Initiative (DSSI) – which was announced by the G-20 on April 15 to help developing countries with the overwhelming debt they owed to bilateral lenders should be critically analyzed. According to experts, it is partial and does not apply to multilateral and private creditors. Money freed up under the DSSI may effectively be used to repay other debts and not to fund the response to the Covid-19 crisis. Therefore, there is the need for the G-20 compelling all creditors to offer debt relief,

Also, it has to be borne in mind that it is postponing repayment and not cancelling debts. Eligible countries under DSSI have already scheduled to repay US$ 115 billion of debt in 2022-24. The deferred payment also will become due around that time casting great difficulties among the developing world.

According to available data collated from various sources, external public debt service of low and middle income countries is projected to reach US$ 273billion in 2020. The G-20 offer, therefore, covers only 3.65% of all the debt service payments to be made in 2020 by developing countries.

A more long-term approach to address the mounting debt should be evolved in the interest of all developing countries, particularly countries in the region. There should be a conscious effort towards creation of a permanent mechanism, under the United Nations, for addressing this issue on a permanent basis rather than treating them on a piecemeal basis.