(3 Minutes Read)

The Kenyan government has prepared three new tax and finance bills to be introduced soon in parliament. The country plans to reintroduce some of the tax hikes that sparked deadly protests earlier this year, announced the government .

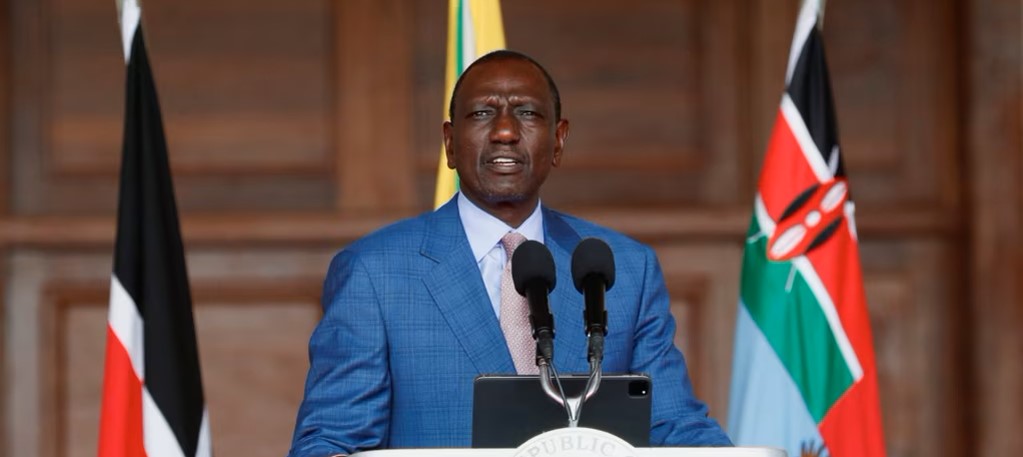

President William Ruto scrapped an unpopular finance bill in June after the protests. Rights groups accused police of a brutal and illegal crackdown that led to more than 60 people being killed, with dozens more arbitrarily arrested. But Kenya’s government desperately needs to boost revenues as it struggles under around USD 80 billion of debt.

It has prepared three new tax and finance bills, to be introduced soon in parliament, and sent out an explainer to the media on Friday. Several proposals from the scrapped finance bill are being reintroduced, including VAT hikes and new taxes on the digital sector. The latter means freelancers working in food delivery and for ride-hailing apps — which have become vital sources of income in recent years — will have to pay income tax for the first time. Such tax hikes are likely to cause upset in a country where a third of the population lives below the poverty line.

Read Also:

https://trendsnafrica.com/kenya-stares-at-wider-debt-burden-upon-abandoning-tax-reforms/

President Ruto said Kenya’s development was “overdue by decades” because it had failed to boost tax revenues. As a result, the country lacks the resources needed for development,” he said, highlighting the 850,000 young people who enter the labour market each year and struggle to find jobs.

He did not address the new bills specifically but said the government aimed to raise tax revenues from 14 percent of GDP to 22 percent within a decade and increase compliance from 70 percent to 90 percent through tech-based automation.