(3 minutes Read)

The region’s economy is likely to expand by 3.8% this year, the Fund said in its World Economic Outlook report this week, marking a cut from its previous forecast of 4.2% due to the potential impact of the U.S. administration’s stance on trade.

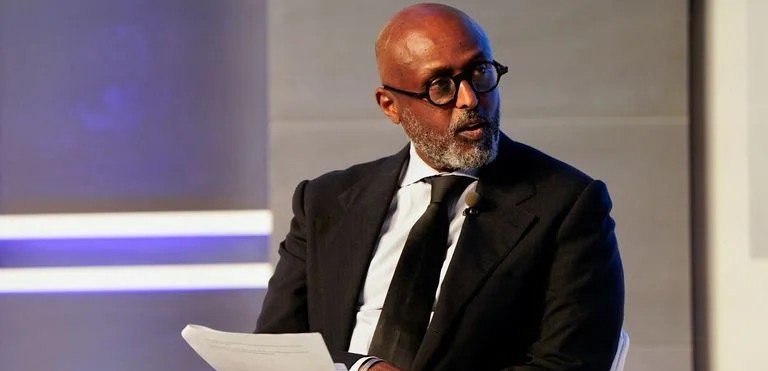

Sub-Saharan African economies should work to increase their domestic revenue collection to avoid having to take on debt amid “turbulent global conditions”, International Monetary Fund Africa Director Abebe Aemro Selassie said.

The region’s economy is likely to expand by 3.8% this year, the Fund said in its World Economic Outlook report this week, marking a cut from its previous forecast of 4.2% due to the potential impact of the U.S. administration’s stance on trade.

Investors sold off risky assets after President Donald Trump announced sweeping tariffs on dozens of U.S. trading partners, pushing up the yields of most issuers in sub-Saharan Africa into double digits, a sign that such so-called frontier economies could struggle to access capital markets.

The average debt-to-economic-output ratio in the region was steady last year at less than 60% of GDP, the IMF said, but some economies like Kenya have been struggling with high debt-servicing costs.

Although the United States is not a major trading partner for many economies in the region, the knock-on effects from its approach to international trade are also piling pressure on the foreign exchange rates of economies, he said.

The projected setback could interrupt a “hard-fought economic recovery” from the global pandemic, a worldwide inflation spike and an interest rate surge that effectively locked many African economies out of foreign capital markets, the IMF said. Growth in the region, home to a wide range of economies, including fairly diversified ones like Tanzania and Senegal, reached 4% last year, surpassing the IMF’s forecast of 3.6%, the Fund said.

Read Also:

https://trendsnafrica.com/imf-predicts-trade-tensions-to-escalate-after-tariff-hikes/

Last year’s robust economic expansion in the region was accompanied by an improvement in macroeconomic imbalances, the IMF said, citing lower average inflation and stable debt levels.