(3 Minutes Read)

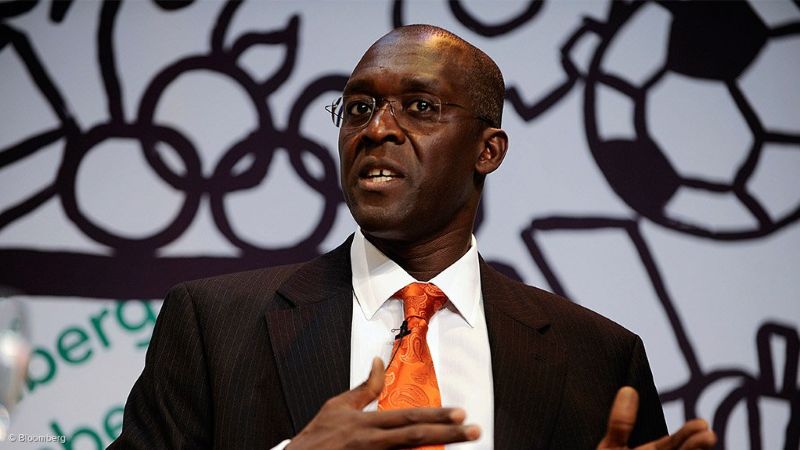

The International Finance Corporation (IFC), the World Bank Group’s private-sector arm, is scaling up local-currency lending and direct investments across Africa to deepen capital markets, cut foreign exchange risks, and attract global institutional capital. Announced by IFC Managing Director Makhtar Diop at the Africa Financial Summit in Casablanca, the initiative seeks to make African projects large and liquid enough to appeal to major investors like BlackRock.

Africa accounted for over USD 15 billion of IFC’s commitments last year, with nearly 30% already in local currencies. The IFC plans to raise that share by partnering with African banks to convert dollar-based resources into local-currency credit lines—boosting liquidity and strengthening domestic lenders.

Economists see the move as a step toward financial sovereignty, enabling African economies to borrow and invest in currencies they control. By encouraging pension funds, insurers, and local investors to hold domestic assets, the initiative could anchor Africa’s financial future in its own savings rather than external cycles.

However, experts caution that success will depend on stable monetary policies, market depth, and strong governance. While mature markets like Nigeria, Kenya, and South Africa could benefit quickly, smaller economies may face challenges due to limited liquidity and weaker institutions.

Read Also;

https://trendsnafrica.com/afdb-creates-facility-for-concessional-lending-and-rating/

Diop emphasized the need for regional financial integration, urging African leaders to create interoperable stock exchanges and cross-border investment platforms: “African savings should finance African growth.” Analysts describe the initiative as a “quiet revolution in development finance”—a shift from aid to partnership that aligns global capital with Africa’s drive for economic self-determination.