The South African Finance Minister Tito Mboweni will table a Special Appropriations Bill, which will give the outline of the funding pattern of the cash-strapped Eskom, which is acting as a drain on the resources of the country.

President Cyril Ramaphosa recently announced an R230billion bailout of the power utility over a period of time. Of that, a significant portion of the bailout fund will be given to Eskom immediately to avoid its collapse. The appropriation bill will have two parts. The first part will detail how much state money is being given to Eskom this fiscal year (2019) and next (2020). Around R32bn will be allocated this fiscal and R62bn in the next fiscal.

The second part will be an explanatory memorandum, which will explain the reforms being undertaken in the power utility. Transparency in the functioning of the utility is critical to bring in interested investors and to justify the government’s expenditure in the project, which has been incurring losses for quite as stretch of time. Shortly Eskom will release its financial results. Market grapevine is that this year’s loses will be close to R 20 billion. In the meantime, the government will be appointing shortly a chief restructuring officer to carry out a thorough study about the type of reforms that are required to make the loss-making energy behemoth to start showing results.

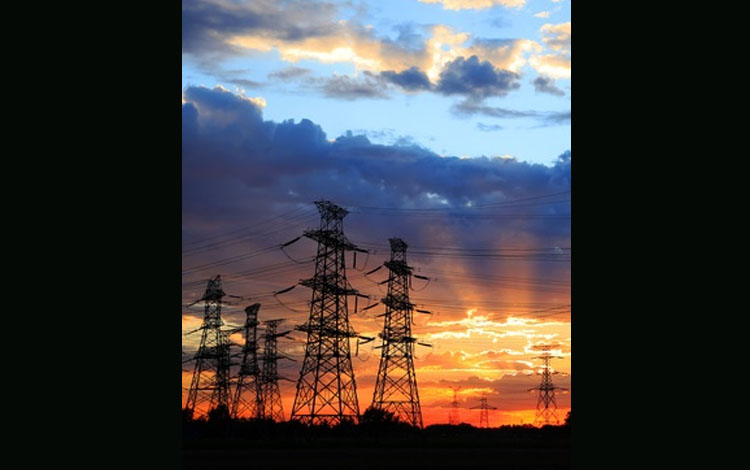

Eskom is facing an accumulated loss of Rand 440 billion debt and expects to report another annual loss this month. The main drawback of the power utility is the unreliable generation due to the aging coal plants, leading to frequent power outages in the first quarter. Eskom provides about 95% of South Africa’s power. The resources for revamping will come from the Revenue Fund. The government is likely to impose conditions to be met by Eskom before any part of the amount is transferred, like in the case of funding by multilateral organizations like World Bank (WB) and International Monetary Fund (IMF) according to the document.

Eskom, earlier known as Escom, was set up in 1922, after an act of the Parliament of the Union ofSouth Africa. It brought together several disparate companies involved in the generation of electricity to supply electricity to top the mining houses. The company was often referred to as the crown jewel among South African state-owned enterprises till recently. Post-1994, after apartheid, Eskom implemented massive electrification scheme, connecting townships and households to the national grid. In 1995 alone, Eskom connected more than 300 000 households. Eskom was named by the Financial Times “Power Company of the Year “ at the Global Energy Awards Ceremony in New York in 2001 and recognized as providing the world’s lowest-cost electricity. The company was making superior technological innovations, increasing transmission system reliability, and developing economic, efficient and safe methods for combustion of low-grade coal.

However, the downfall since then was swift. Today, Eskom is looking at a debt of R430bn, which is about 15% of the state’s total debt. The arrears due from municipalities are growing by Rand 1bn per month. The wage bill of the company zoomed from Rand 9.5bn annually in 2007 to Rand 29.5bn in 2018. Eskom has a total installed electricity capacity of more than 45 000 MW.