(3 minutes read)

Carbon markets offer an incredible opportunity to unlock billions for the climate finance needs of African economies while expanding energy access, creating jobs, protecting biodiversity, and driving climate action. However, Africa currently produces only a tiny percentage of its carbon credit potential.

Carbon markets offer an incredible opportunity to unlock billions for the climate finance needs of African economies while expanding energy access, creating jobs, protecting biodiversity, and driving climate action. However, Africa currently produces only a tiny percentage of its carbon credit potential.

The global carbon credit market is valued at around UDS 909bn. Africa is beginning to tap into this lucrative resource but a more coordinated effort across the continent could reap rich benefits. Africa Carbon Markets Initiative (ACMI), aims to support the growth of carbon credit production and create jobs in Africa.

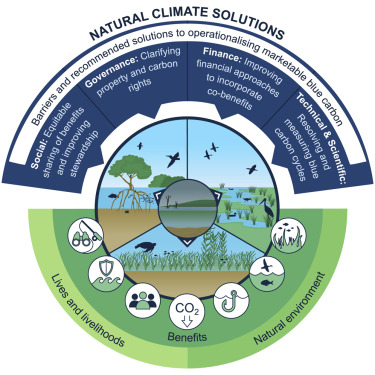

Carbon credit markets enable industrialised nations and businesses to offset their carbon emissions by investing in eco-friendly projects elsewhere. One carbon credit or offset represents one metric ton of carbon dioxide removed from the earth’s atmosphere. Africa, with its wealth of renewable energy sources, can benefit considerably through judicious and informed use of these markets. South Africa, Namibia. Morocco, Kenya, Malawi, Gabon, Nigeria, and Togo have been pursuing this concept through different initiatives. Efforts including forest regeneration, and harnessing sustainable energy sources like solar, wind, hydrogen, and hydroelectric power have been growing and contributing to the overall global carbon offset cause.

Progress has been made towards agreeing on the processes and methodologies that countries need to follow to access the carbon markets. And there are many opportunities – not least the benefits that will accrue by diverting a share of the proceeds to support the most vulnerable countries to adapt to climate change.

Read Also:

https://trendsnafrica.com/lafarge-launches-low-carbon-cement-for-eco-construction-in-nigeria/

https://trendsnafrica.com/huawei-digital-power-to-help-sa-to-achieve-carbon-neutrality/

ACMI announced a bold ambition for the continent—to reach 300 million credits produced annually by 2030. This level of production would unlock 6 billion in income and support 30 million jobs. By 2050, ACMI is targeting over 1.5 billion credits produced annually in Africa, leveraging over $120 billion and supporting over 110 million jobs. Commenting on ACMI’s ambition, Damilola Ogunbiyi, the CEO of SEforALL and a member of the ACMI’s steering committee, stated that the current scale of financing available for Africa’s energy transition is nowhere close to what is required. Achieving the Africa Carbon Markets Initiative targets will provide much-needed financing that will be transformative for the continent.