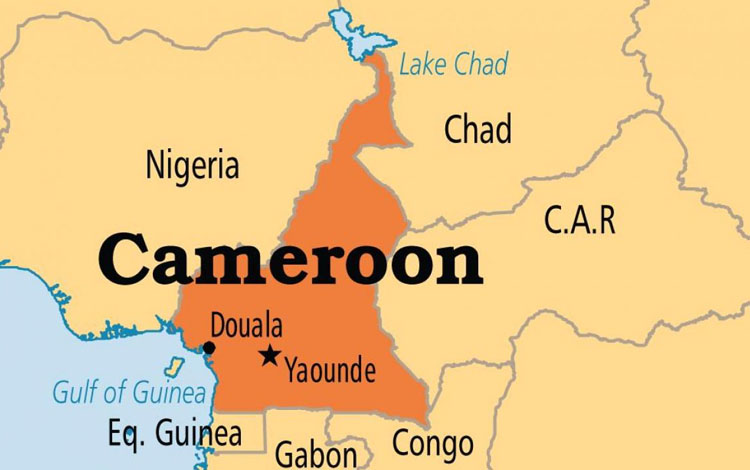

· The digital economy has become the new focus for economic growth of Cameroon which has the ambition to emerge as a hub in the Central Africa sub-region.

· To push this transformation, the Cameroon government has updated its tax scheme 2021 to promote innovative ICT start-ups.

The digital economy has become the new focus for economic growth of Cameroon which has the ambition to emerge as a hub in the Central Africa sub-region. To push this transformation, the Cameroon government has updated its tax scheme 2021 to promote innovative ICT start-ups.

Eligibility for the start-up promotion scheme is subject to the consent of Approved Management Centres dedicated to start-ups and as specified by the instrument issued by the Minister in charge of finance. The start-ups that get approved under the scheme will have an incubation period of not more than 5 years, and will be exempt from all taxes, duties, levies and payments, except social security contributions. After the completion of the incubation phase, in the event of the sale of the start-up, a capital tax gains rate of 10% – instead of the standard 16.5% – will be applied to the increase in the value.

If the company becomes operational at the end of incubation it can benefit from a host of incentives for a period of five years. These include exemption from the business licence tax, exemption from registration fees on the incorporation, extension or capital increase instruments, exemption from all tax and employer’s charges on salaries paid to their employees except social security contributions, a reduced 5% rate of income tax on movable capital revenue on dividends paid to shareholders and interest paid to investors.

The dedicated policy to support ICT start-ups reflects the commitment of the Cameroon government to develop the digital economy. These tax incentives are expected to attract investment to Cameroon, generate jobs, facilitate capital transfers, and encourage research and technology development, and structural development in less-developed areas. Accurate implementation is likely to improve overall economic welfare of Cameroon through increased economic growth and government tax revenue.