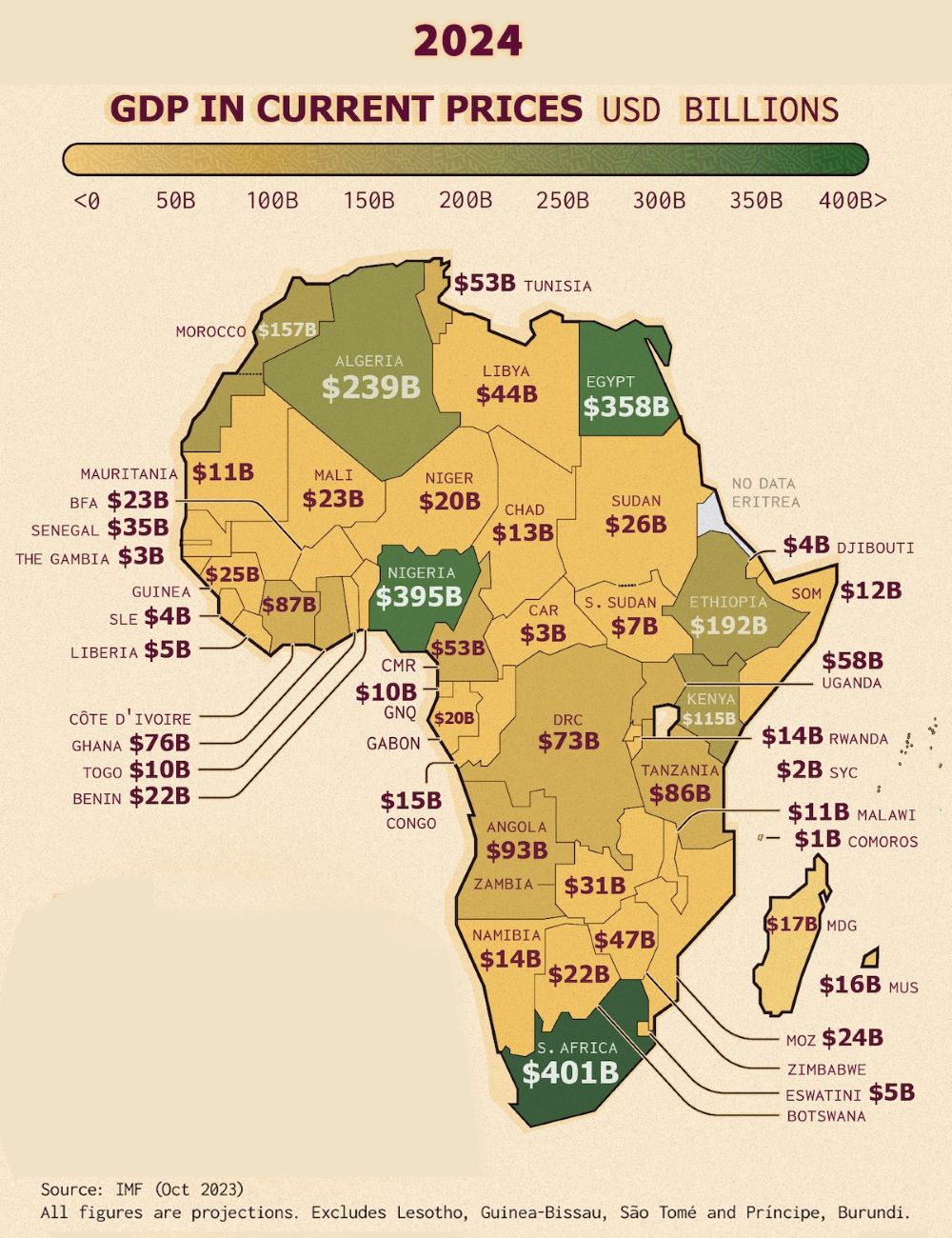

There are a few ways in which one can measure the growth of Africa. Vectors or macroeconomic data alone will not be able to explain the growth dynamics of a region, which is having 55 countries of various stages of growth. Amongst them, there are the least developed to upper-income countries. A good number of them-22 to be precise- are fragile economies upfront with internal problems of governance staring at them.

Demographic variance is at play. Of the 1.2 billion people the continent inhabits, there are countries like Nigeria, Ethiopia, the Democratic Republic of Congo, and South Africa, which bear the brunt of the population load. There are 13 small states which have a population much below the optimal level. These states can give an erroneous development index measured in terms of per capita income. That has created anomalies also. For instance, Indian Ocean Island countries like Seychelles and Mauritius can be ranked as of now or shortly among the developed world. The moot point is whether such categorization is valid amidst huge disparity of income, where a mathematical mean (average) camouflages the ground-level reality.

An impressive array of data emerges gauging the mineral wealth of the continent. Does that tag of mineral-rich continent help Africa, when the beneficial flows are skewed due to several factors including a colonial hangover, wherein the ex-colonizers continue to reap benefits disproportionally? From hydrocarbons to rare earth like cadmium, lithium, silicon, etc, which are in great demand triggered by an unprecedented surge in demand for electronic hardware, Africa can boast of having huge deposits. The proof of pudding is in eating; not only does potential have to be tapped but also its benefits should permeate to the grassroots. Despite these huge assets, Africa and Africans continue to be poor. The sordid story is the prediction that the plight may continue unless “Africans work for Africa” and do not leave their growth imperatives to be decided or calibrated by outside agencies.

Is Africa ready for a policy overhaul to prioritize its future growth path? Discernible gaps are noticeable. Foremost is the invisible presence of two Africas- Sub-Saharan and Northern Africa. While there are 48 countries in the former grouping, Northern Africa has only seven countries. The difference does not end there. Northern Africa is categorized with Middle Eastern Countries, creating an economic bloc called MENA (Middle East Northern Africa) countries. To a great extent, such out-of-place categorization has taken the sheen out of concepts like the African Union or the much-touted African common market, popularly known as AfCFTA.

Excessive food imports have cast some deleterious macroeconomic distortions including rampant food shortages, high prices, and importantly eroding local currencies. Unfortunately, these unsavory developments play out as vicious cycles of perennial nature. These also explain the heavy indebtedness of the continent. The doles and concessional aids including from the multilateral banks are not enough to service the debts, not to speak of timely redemption of principal. That has led to an increasing number of countries in debt traps.

The continent endowed with the largest land mass and fertile land holdings still importing foodgrains to feed the teeming millions is a paradox. Sudden oil wealth brought resources to some countries. The flip side of that unexpected growth dynamics is the abandoning of agriculture with the rural folks migrating either to cities or beyond shores to find a better living. Systematic development of agriculture can reverse the trend; not only by abating excessive imports but also the large-scale migration in a curious way that will also have several spin-offs including strong local currencies since a sizable amount of foreign exchange is expended on the import of food grains. New ideas on agriculture should emerge including precision agriculture, corporate farming, leased farming, and the like.

Happily, there are many takers among African countries for the concept of value addition to its primary goods, which are exported in raw forms. Yet, such initiatives have touched only fringes such as cashew processing, timber exports, etc. It is time to explore more avenues of value addition in the hydrocarbon sector, coffee, tea, cocoa, etc to cash on the potential. Extrapolate these trends to sectors like mineral and rare earth processing to have an idea about the employment that can be generated. It is mindboggling, to say the least. Recently, a few organizations like ARISE have come up with creating a consortium of investors desirous of becoming stakeholders in Africa. Organizations like the World Bank, the IMF, and the European Union should be supportive of these initiatives since they can deepen the private sector culture in the continent.

Undeniably, vectors can present a picture that Africa is growing. The moot point is whether the growth was in the right direction or the growth traction was beneficial to its people. It is time for Africa to adopt a growth model by its people, for its people, and to its people.