Is the real estate sector in South Africa in the verge of a bust? Many think so; others are waiting for clear cut data to emerge. Those who are convinced about a real estate slowdown say that both listed and private property companies in the country are suffering from poor economic growth, spiraling and cascading municipal rates and taxes and importantly lurking political and policy uncertainty. They feel that these are the major reasons for South African real estate majors focusing on major projects outside the country, cutting down their domestic exposures.

There are two research studies, which lend credence to the flight of capital and increased investments by the real estate companies outside. A New York-based Real Capital Analytics indicated that SA-headquartered property investors parked a whopping US$4.9 billion (R68 billion) overseas in 2018. Another research outfit- Stanlib-is of the view that South Africa’s listed property companies now have offshore exposure of 47% compared to nil exposure a decade ago.

Some of the statistics are revealing. The 2016 data indicates that the realty sector contributed 5.6% to GDP and was worth about R500bn. About 46% of the estimated value of the sector was in overseas markets. Growth in residential property prices also remained subdued in 2018. According to some estimates of the $4.9 billion invested offshore in 2018, over 60% was invested in retail. Office and industrial property accounted for the rest of investment outside the country.

One of the important deals during 2018 was the purchase of a Spanish retail asset portfolio by Vukile Property Fund valued at 489 million pounds from Unibail-Rodamco. Another notable deal was that of Oxygen Asset Management, which purchased the Riverbank Property Fund in Central London for 390 million Pounds on behalf of South Africa’s Zeno Capital.

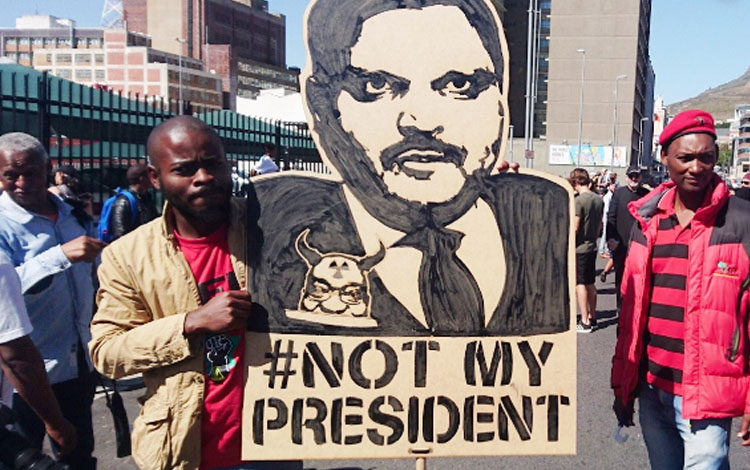

A good number of people feel that the trend will be reversed and the realtors parking their investments outside South Africa, my bring back the investments once the economy picks up. Despite the assurances by the present administration of streamlining the economic policies and investment procedures, nothing significant is happening on the ground. South Africa has to traverse a long distance toward ease of doing business and making the investments attractive.