(3 minutes read)

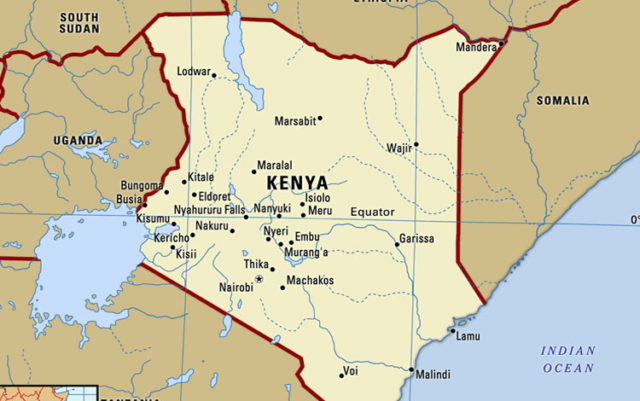

- Kenya’s economic activities further eased in July as businesses relaxed due to expansions in output, new orders and employment during the month

- Stanbic Bank Kenya’s Purchasing Managers Index (PMI) fell for the second straight month in July

- The PMI dropped to 50.6 from 51.0 in June. Any figure above 50 is considered to be a positive one and below 50 a sign of contraction of the business activities

Kenya’s economic activities further eased in July as businesses relaxed due to expansions in output, new orders and employment during the month.

Stanbic Bank Kenya’s Purchasing Managers Index (PMI) fell for the second straight month in July. The PMI dropped to 50.6 from 51.0 in June. Any figure above 50 is considered to be a positive one and below 50 a sign of contraction of the business activities. The data shows that there was only a marginal improvement in operating conditions across Kenya’s private sector. Domestic demand improved by the second slowest pace riding on the back of lifting public health restrictions after the first wave of pandemic, with some firms reporting a drop in customer numbers.

Output, new orders and employment indices, all fell to three month lows as businesses reported slow sales growth. People postponed buying new inputs. There was also significant developments in the price front also as prices of imported goods rose sharply due to changes in the tax system. Higher fuel costs and input shortages led to the quickest rise in input prices since March 2020.

Despite inflation, business confidence improved in July as nearly a third of the businesses gave a positive forecast for output over the next 12 months. A few companies revealed plans to open new branches and increase their promotional efforts. However, this was not reflected in the functioning of the capital market, which continued to suffer from capital flight in the second quarter of this year as foreign investors pulled back from risky markets.